Taken and extracted from STL Partner's article Telco edge computing: What’s the operator strategy?, May 2020

Edge computing is a strategic opportunity for telcos. We examine the driving needs and applications for telco edge computing, describe the market and the options for telcos, discuss their partnerships with hyperscalers and recommend key actions.

Edge computing can help telcos to move up the value chain

The edge computing market and the technologies enabling it are rapidly developing and attracting new players, providing new opportunities to enterprises and service providers. Telco operators are eyeing the market and looking to leverage the technology to move up the value chain and generate more revenue from their networks and services. Edge computing also represents an opportunity for telcos to extend their role beyond offering connectivity services and move into the platform and the application space.

However, operators will be faced with tough competition from other market players such as cloud providers, who are moving rapidly to define and own the biggest share of the edge market. Plus, industrial solution providers, such as Bosch and Siemens, are similarly investing in their own edge services. Telcos are also dealing with technical and business challenges as they venture into the new market and trying to position themselves and identifying their strategies accordingly.

Telcos that fail to develop a strategic approach to the edge could risk losing their share of the growing market as non-telco first movers continue to develop the technology and dictate the market dynamics. This report looks into what telcos should consider regarding their edge strategies and what roles they can play in the market.

We focus on:

- Edge terminology and structure, explaining common terms used within the edge computing context, where the edge resides, and the role of edge computing in 5G.

- An overview of the edge computing market, describing different types of stakeholders, current telecoms operators’ deployments and plans, competition from hyperscale cloud providers and the current investment and consolidation trends.

- Telcos challenges in addressing the edge opportunity: technical, organisational and commercial challenges given the market.

- Potential use cases and business models for operators, also exploring possible scenarios of how the market is going to develop and operators’ likely positioning.

- A set of recommendations for operators that are building their strategy for the edge.

What is edge computing and where exactly is the edge?

Edge computing brings cloud services and capabilities including computing, storage and networking physically closer to the end-user by locating them on more widely distributed compute infrastructure, typically at smaller sites.

One could argue that edge computing has existed for some time – local infrastructure has been used for compute and storage, be it end-devices, gateways or on-premises data centres. However, edge computing, or edge cloud, refers to bringing the flexibility and openness of cloud-native infrastructure to that local infrastructure.

In contrast to hyperscale cloud computing where all the data is sent to central locations to be processed and stored, edge computing local processing aims to reduce time and save bandwidth needed to send and receive data between the applications and cloud, which improves the performance of the network and the applications. This does not mean that edge computing is an alternative to cloud computing. It is rather an evolutionary step that complements the current cloud computing infrastructure and offers more flexibility in executing and delivering applications.

Edge computing offers mobile operators several opportunities such as:

- Differentiating service offerings using edge capabilities

- Providing new applications and solutions using edge capabilities

- Enabling customers and partners to leverage the distributed computing network in application development

- Improving network performance and achieving efficiencies / cost savings

As edge computing technologies and definitions are still evolving, different terms are sometimes used interchangeably or have been associated with a certain type of stakeholder. For example, mobile edge computing is often used within the mobile network context and has evolved into multi-access edge computing (MEC) – adopted by the European Telecommunications Standards Institute (ETSI) – to include fixed and converged network edge computing scenarios. Fog computing is also often compared to edge computing; the former includes running intelligence on the end-device and is more IoT focused.

These are some of the key terms that need to be identified when discussing edge computing:

- Network edge refers to edge compute locations that are at sites or points of presence (PoPs) owned by a telecoms operator, for example at a central office in the mobile network or at an ISP’s node.

- Telco edge cloud is mainly defined as distributed compute managed by a telco. This includes running workloads on customer premises equipment (CPE) at customers’ sites as well as locations within the operator network such as base stations, central offices and other aggregation points on access and/or core network. One of the reasons for caching and processing data closer to the customer data centres is that it allows both the operators and their customers to enjoy the benefit of reduced backhaul traffic and costs.

- On-premise edge computing refers to the computing resources that are residing at the customer side, e.g. in a gateway on-site, an on-premises data centre, etc. As a result, customers retain their sensitive data on-premise and enjoy other flexibility and elasticity benefits brought by edge computing.

- Edge cloud is used to describe the virtualised infrastructure available at the edge. It creates a distributed version of the cloud with some flexibility and scalability at the edge. This flexibility allows it to have the capacity to handle sudden surges in workloads from unplanned activities, unlike static on-premise servers.

Figure 1 shows the differences between these terms.

Network infrastructure and how the edge relates to 5G

Discussions on edge computing strategies and market are often linked to 5G. Both technologies have overlapping goals of improving performance and throughput and reducing latency for applications such as AR/VR, autonomous vehicles and IoT. 5G improves speed by increasing spectral efficacy, it offers the potential of much higher speeds than 4G. Edge computing, on the other hand, reduces latency by shortening the time required for data processing by allocating resources closer to the application. When combined, edge and 5G can help to achieve round-trip latency below 10 milliseconds.

While 5G deployment is yet to accelerate and reach ubiquitous coverage, the edge can be utilised in some places to reduce latency where needed. There are two reasons why the edge will be part of 5G:

- First, it has been included in the 5G standards (3GPP Release 15) to enable ultra-low latency which will not be achieved by only improvements in the radio interface.

- Second, operators are in general taking a slow and gradual approach to 5G deployment which means that 5G coverage alone will not provide a big incentive for developers to drive the application market. Edge can be used to fill the network gaps to stimulate the application market growth.

The network edge can be used for applications that need coverage (i.e. accessible anywhere) and can be moved across different edge locations to scale capacity up or down as required. Where an operator decides to establish an edge node depends on:

- Application latency needs. Some applications such as streaming virtual reality or mission critical applications will require locations close enough to its users to enable sub-50 milliseconds latency.

- Current network topology. Based on the operators’ network topology, there will be selected locations that can meet the edge latency requirements for the specific application under consideration in terms of the number of hops and the part of the network it resides in.

- Virtualisation roadmap. The operator needs to consider virtualisation roadmap and where data centre facilities are planned to be built to support future network

- Site and maintenance costs. The cloud computing economies of scale may diminish as the number of sites proliferate at the edge, for example there is a significant difference in maintaining 1-2 large data centres to maintaining 100s across the country

- Site availability. Some operators’ edge compute deployment plans assume the nodes reside in the same facilities as those which host their NFV infrastructure. However, many telcos are still in the process of renovating these locations to turn them into (mini) data centres so aren’t yet ready.

- Site ownership. Sometimes the preferred edge location is within sites that the operators have limited control over, whether that is in the customer premise or within the network. For example, in the US, the cell towers are owned by tower operators such as Crown Castle, American Tower and SBA Communications.

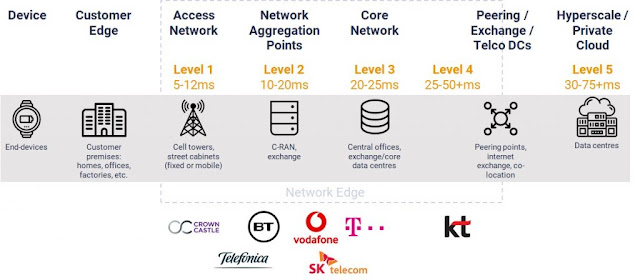

The potential locations for edge nodes can be mapped across the mobile network in four levels as shown in Figure 2.

Figure 2: possible locations for edge computing